As you prepare for retirement, you have a number of decisions to make regarding your SERS retirement benefit. You will document your decisions on a retirement estimate request. Researching and considering all of your options well in advance of your retirement will give you the most time to make those important decisions, many of which cannot be changed later.

Read through the basic information and options outlined here and make a list of questions you may have. Then schedule an appointment with a pension plan specialist to discuss your questions and all of your options by calling 1.800.633.5461.

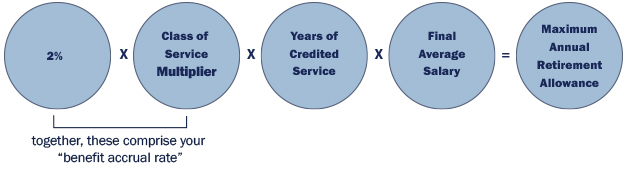

Your annual pension is calculated using a formula based on your SERS class of service (listed on your annual member statements), years of service, salary and age.*

For most SERS members, that's 2.5% of their final average salary for each year of credited service, but this can change depending on your class of service.

Divide the annual amount by 12 for the monthly pension amount.

*Pennsylvania State Police troopers with 20 or more years of service should contact a pension plan specialist for additional information.

If you haven't reached SERS normal retirement age, your benefit could be reduced for early retirement. The further you are from SERS normal retirement age, the greater the reduction. SERS normal retirement age is 65, 60, 55, or 50 depending on your class of service, which is listed on your annual member statements. You can check your most recent statement in SERS online members services.

When you complete your application for annuity, you must select a monthly payment option.

While all plans pay you a monthly benefit for life, one option provides the highest monthly payment for as long as you live, one ensures that the full benefit to which you are entitled over your expected lifetime is paid to you or, if you die before receiving payments totaling that amount, the remainder will be paid to your beneficiaries, and others provide monthly payments to someone after your death.

In addition, if you were hired before Jan. 1, 2011, you have the option to withdraw all or a portion of your contributions and interest in a lump sum at retirement. If you take a lump sum withdrawal, your monthly payments will be reduced accordingly.

If you choose a payment option that provides a death benefit, either the MSLA, Option 1, or you design an Option 4 with a remaining present value death benefit feature, you will name a beneficiary or beneficiaries. The beneficiaries you list on your application for annuity will become effective on your retirement date. Until your retirement date, the beneficiary form you have on file with SERS will remain in effect.

If you name your spouse as a beneficiary and later divorce, file a new Beneficiary Nomination form either naming a new beneficiary or affirming that you want your ex-spouse as your beneficiary.

If you choose a payment option that provides a survivor benefit, either Option 2, Option 3, or you design an Option 4 with a survivor feature, you will list your survivor and provide date of birth documentation such as a birth certificate or two other forms of valid identification for that person. For a list of all acceptable forms of documentation, see Guide for Retiring Members.

If you name a beneficiary or survivor under the age of 18, you must list the name and address of the minor's guardian.

If you served in the military or worked for the commonwealth in the past, you may be eligible to purchase that service with SERS.

There are a number of ways to request an estimate of your monthly benefit payments. You can produce your own general estimates using our online calculators. If you are within a year of retirement, request an estimate calculated according to your individual situation from your pension plan specialist.

Contact your HR Office to see if you have any debts and satisfy those debts before terminating employment. Overdrawn leave, unreturned equipment or uniforms, or other debts to your employer will delay your first payment. In addition, the commonwealth can claim the contributions you made to SERS and the interest earned on those contributions to satisfy any debt you have when you leave state employment.

A debt to your employer (e.g. overdrawn leave or unreturned equipment/uniforms), will delay the termination notice and your distribution.

If you have an outstanding debt that exceeds the amount you expect to receive in your final pay, and you work for an employer under the Governor’s jurisdiction*, direct questions regarding why there is an overpayment to your Human Resources Office or the HR Service Center at (866) 377-2672. Questions regarding how to repay the debt should be directed to the Bureau of Commonwealth Payroll Operations (BCPO) Accounts Receivable Section at (717) 787-3377 or email at RA-OBOVERPAYMENTS@pa.gov.

Your employer, the State Treasury and we have a lot of work to do to process your first payment - work that can't even begin until after you receive your last pay. In most cases, that work takes between six and eight weeks from your retirement date.

Your SERS pension does not include and SERS does not offer a retiree health care program. While different employers handle retiree health benefits in different ways, agencies under the Governor's jurisdiction offer the Retired Employees Health Program (REHP). REHP is run by the Governor's Office of Administration through the Pennsylvania Employees Benefit Trust Fund (PEBTF).

We can help you determine if you qualify for REHP (based on your years of service), enroll in REHP as part of the retirement process, pay your REHP premiums by withholding them from your pension payments, change dependents, and cancel coverage.

In addition to the general tax information that applies to your pension payments throughout retirement, there are a number of things you should be aware of as you prepare to retire.

If you would like us to withhold money from your monthly pension payments for federal income tax, you can authorize SERS to start, stop, or change the amount. We can mail you a form upon request by calling 1-800-633-5461.

If you retire before the year you turn 55 and you choose to withdraw any of your contributions and interest when you retire, the taxable portion may be subject to an additional 10% federal excise tax unless you roll the money directly into a traditional IRA or other qualified plan, like your deferred compensation account. Rollovers may allow you to delay paying federal income taxes on the money until you withdraw it from the IRA or other qualified plan, when your tax liability may be lower. Contact a tax advisor or financial planner to discuss the different tax consequences.