| If you become an employee of a SERS-participating employer on or after Jan. 1, 2019, in most cases, you will automatically become a member of the SERS hybrid retirement plan in the A-5 class of service. There are a few exceptions related to law enforcement or security positions (state police, corrections, etc.). |

|

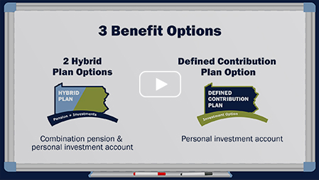

A hybrid plan means that a portion of your retirement benefit comes from a pension plan that features guaranteed monthly payments for life, and a portion comes from a defined contribution investment plan, and the amount of money you earn from contributions by you and your employer and your personal investment choices.

Your mandatory contribution to your retirement benefit is 8.25% of your pay, which is split between the two plans with 5% going to your pension and 3.25% going to your investment plan. Your pension contribution rate could increase or decrease each year based on the investment performance of the SERS Fund, referred to as “shared-risk/shared-gain.” Through shared-risk/shared-gain, your contribution rate could drop as low as 2% of your pay and could increase to a maximum 8% of your pay.

Your employer’s mandatory contribution to your pension is calculated each year based on the assets and liabilities of the SERS pension fund. Their mandatory contribution to your investment plan is 2.25% of your pay.

In general, the pension portion of your benefit is guaranteed to grow by 1.25% of your pay for each year you work for a SERS-participating employer. Income or loss in your investment plan is based on your investment choices and the markets.

You have 45 days from your membership in SERS to choose to stay in your current hybrid plan A-5 class of service, or to switch to one of two other options.

Your mandatory contribution to your retirement benefit would be 7.5% of your pay, which would be split between the two plans with 4% going to your pension and 3.5% going to your investment plan. Your pension contribution rate could increase or decrease each year based on the investment performance of the SERS Fund, referred to as “shared-risk/shared-gain.” Through shared-risk/shared-gain, your contribution rate could drop as low as 1% of your pay and could increase to a maximum 7% of your pay.

Your employer’s mandatory contribution to your pension would be calculated each year based on the assets and liabilities of the SERS pension fund. Their mandatory contribution to your investment plan would be 2% of your pay.

In general, the pension portion of your benefit would be guaranteed to grow by 1% of your pay for each year you work for a SERS-participating employer. Income or loss in your investment plan would be based on your investment choices and the markets.

Your mandatory contribution to your investment plan would be 7.5% of your pay and your entire retirement benefit would be determined by the amount of money you invest, your investment choices, and the markets.

Your employer's mandatory contribution to your investment plan would be 3.5% of your pay.

When your SERS-participating employer adds you to their payroll, they include information like your home address. That payroll information is automatically sent to us. That is how we learn that you are a new SERS member. At that point we will mail you a welcome package that includes a letter with additional information and instruction, along with resources to help you choose your retirement benefit plan, including a New Member Plan Comparison and a features and highlights of the Defined Benefit Plan and a features and highlights of the Defined Contribution Plan.

|

New Member Plan Comparison Calculator |

|

SERS Materials & Counseling |

|

Financial Planner/Tax Consultant |